A SSAS is a flexible pension scheme with many advantages over more conventional schemes.

One of the advantages of a SSAS is the ability to purchase a wide range of investments and products. This includes purchasing commercial property, making loans to companies or third parties, and the ability to purchase other types of non-standard investments, such as unquoted shares.

What is an unquoted share?

An unquoted (or unlisted) share is a share of a private company which is not listed on a recognised stock exchange, for example the London Stock Exchange. Traditionally they are shares in small to medium sized companies and can be considered as “higher risk” than more conventional investments, however they can be a valuable asset for the right investor.

Can my SSAS invest in unquoted shares?

The short answer to this is yes, your SSAS can invest in unquoted shares.

As with any investment you need to be sure you understand all the risks involved and, if necessary, seek independent financial advice.

For any client considering this type of investment we would expect them to have previous experience in investing in unquoted shares, be a high net worth individual or perhaps be seen as a sophisticated investor. There are also some limitations which are governed by HMRC.

What are the HMRC limitations on unquoted shares?

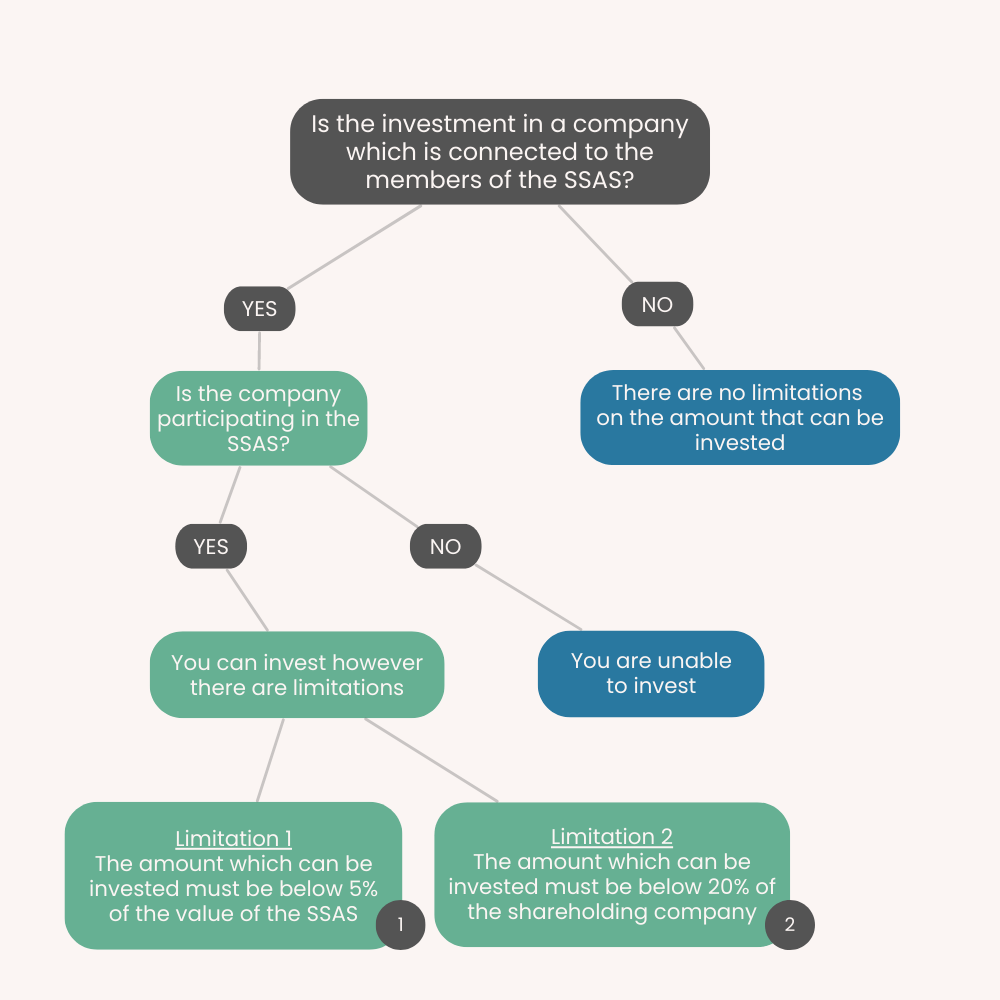

This largely depends upon:

- whether the investment is in a company which is connected to the members of the SSAS, and

- whether the company is participating in the SSAS.

I’ve broken this down in the diagram below:

1. This is the net market value of the assets of the SSAS as at the date of purchase. This means any liabilities (for example a mortgage) will need to be taken into account and investment valuations may need to be brought up to date.

2. If the company in which you are looking to invest in owns more than £6,000 of taxable property (for example computer equipment, furniture, and machinery), the amount that can be invested is limited to less than 20% of the company’s shareholding (10% if it’s an investment company). This limit applies to all the scheme members and any connected parties. i.e. the combined total shareholding between the SSAS, the scheme members and any other connected parties, in respect of an trading company needs to be below 20%.

A case study

One of our clients partly owns and runs a large established Bristol company. The client’s spouse and two adult children work for the company and they are all members of the companies SSAS.

He currently owns 10% of the shares in the company and there are four other directors who each own 15%. The remaining balance of 30% are owned by other senior members of staff all of which are unrelated/unconnected persons.

The client is not related or connected to any of the other four directors or shareholders, and they are not members of the SSAS.

Based on the above, there is the potential for the SSAS to purchase up to 9.9% of the company’s shares in the principal company for example should a co-investor be looking to sell or dilute their shareholding,

In accordance with the above the purchase price would also need to be less than 5% of the net asset value of the SSAS.

Things to consider

Capital

As mentioned, investing into an unquoted company can be considered ‘high risk’. It is important that all the members of a SSAS do this with their eyes open and understand the risks involved. For example, the original capital sum may not be protected and there will be a risk that you will not receive the original sum back.

Valuations

From time to time a market value of the unquoted shares will be required for the administration of the SSAS. For example, in the event of a member retiring or for HMRC reporting. It can sometimes be difficult to value an unquoted share and it needs to be borne in mind how a market valuation can be obtained at short notice.

Dividends

As with any investment you would expect some sort of return. Investment returns such as dividends are not guaranteed, and it should be checked what returns are being paid or forecast.

Liquidity

From time to time a SSAS will need cash to be able to meet its liabilities. For example, the payment of retirement benefits or the payment of professional fees. It can be difficult to sell unquoted shares at short notice (for example, if/when a buyer is found or perhaps at a pre-agreed future trigger date) so sufficient liquidity should remain in the SSAS.

Financial advice should be sought where necessary.

How to purchase

We carry out due diligence in advance in respect of all proposed unquoted investments to enable us to make sure it complies with HMRC regulations and is an appropriate investment for your SSAS.

I hope you have found this useful. If you would like more information on unquoted shares, the Morhart SSAS, and the service we provide, please contact me directly. I’d be delighted to hear from you.

The author

Andy Rogers

Andy is a director of Morhart Pension Services Ltd. He's a lovely guy with a passion for pensions.

[email protected]

0117 457 7784

View Andy's LinkedIn profile