What's a SSAS? In the last blog I mentioned that, as an accidental salesman, I have been shouting about what a SSAS can do and also that I’m still surprised by how many people have either never heard of a SSAS or don’t appreciate what it can do.

So, I thought it might be helpful to provide a back to basics look at SSASs - what they are, what they can do and why everyone who can should have one!

When writing about pensions it can be difficult to avoid using jargon, so with this in mind, this is me providing information about SSASs in as jargon free language as possible…

So what's a SSAS?

SSAS stands for Small Self-Administered Scheme.

A SSAS is a UK pension scheme and a tax-free environment governed by HMRC rules. A SSAS is used to build up funds which can then be paid out to you at retirement.

The tax-free advantages of a SSAS, and other UK pension schemes, are there to encourage you to save for your retirement.

The difference between a SSAS and a conventional pension scheme is flexibility. In a conventional pension scheme, you may be asked how you would like your funds to be invested (low, medium or high risk), money is paid into said scheme, and this is then invested for you. In a SSAS, the members, who will also be trustees of the SSAS, have direct control of the scheme and how the funds are invested.

OK, so what can I invest in?

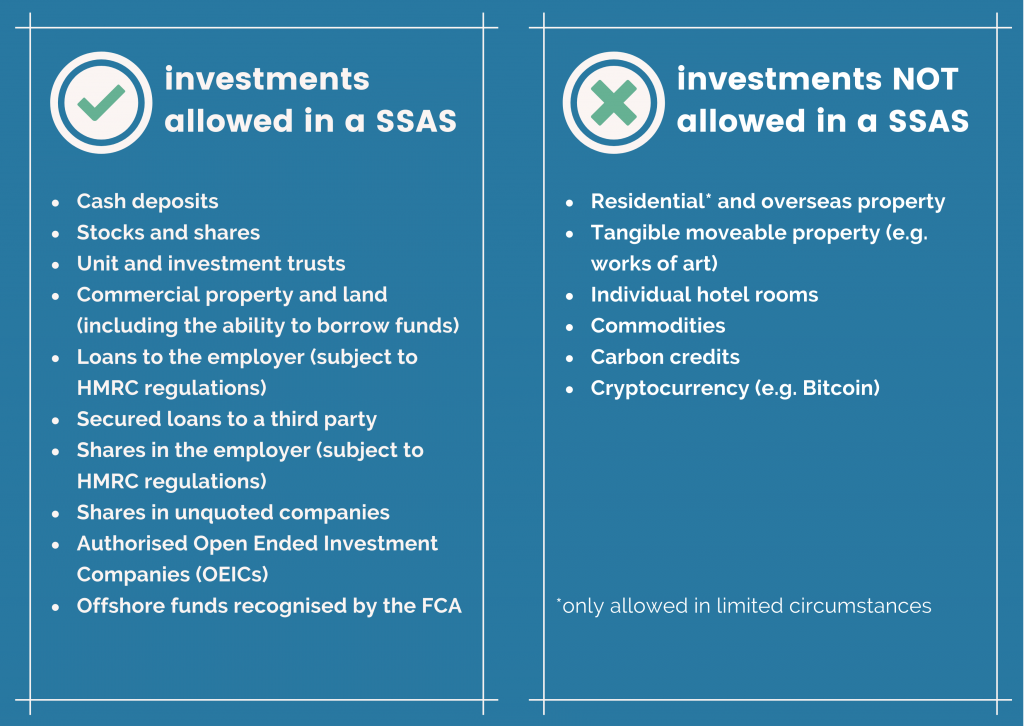

Before you start to think that you can invest in anything in a SSAS, to keep the tax-free status of a SSAS, there are limitations! Some examples of allowable investments and those that are not allowed are as follows:

With a SSAS you are in control, and you can see from the above that there are opportunities to make a SSAS work for your business.

Since starting Morhart we have had requests for a variety of investments. We are in the process of purchasing our first properties on behalf of our clients including a restaurant, land for development and an industrial unit. Not all investments are allowable under HMRC rules and therefore each investment is looked at on a case by case basis.

A tax-free haven

To encourage you to save for your retirement, UK pension schemes are granted generous tax breaks.

Payments In

A company will receive corporation tax relief for contributions that are ‘wholly and exclusively for the purposes of the business’.

Income tax can be reclaimed up to 100% of earnings for contributions you pay in personally. Basic rate of tax will be paid into your SSAS, higher rate is reclaimed using your Tax Return.

Once In

All investment income and capital growth (excluding dividends) will be tax free.

As an example, if you personally owned a commercial property which you rented, you would pay tax on the rental income. If however, the property was purchased by a SSAS, you would pay no tax on the rent.

As with most things there are thresholds. There is a threshold on the amount you can save annually together with the total value of your funds when they are paid out. If you would like more information on this, please let me know.

Transfers in from your other pension schemes

SSASs do not need to be 100% funded by contributions. It is also possible to transfer in other pension schemes you have, such as personal pension plans or money purchase occupational schemes. These can then be used to take control and invest the way you want, for example the purchase of a property.

Retirement, finally

Now that you have saved and built up your SSAS, it is time to realise the benefit and look to take the funds out as retirement benefits

A SSAS is no different to any other pension scheme in that it is ultimately there to be used to provide an income in retirement. 25% of your funds can be taken out as a tax-free cash sum from age 55 (57 from 6 April 2028); the remainder will be taxed at your marginal rate.

The difference between a SSAS and many other pension schemes is the flexibility in the way you can take them:

- You can draw an income direct from the SSAS (this is sometimes known as income drawdown) as opposed to purchasing an annuity (although it is possible to purchase an annuity at any time).

- You can phase your retirement which means you can take your retirement benefits in stages over time. Sounds obvious but this is useful if you looking to phase your retirement by ‘slowing down’ your working life as opposed to fully retiring in one go.

Again, there are thresholds and the level of benefits you can take out can be limited, for example the tax element may not always be 25%.

We have started to pay our first clients both in terms of tax-free cash and providing ad-hoc and regular incomes to clients. The pensions are paid using our payroll system, to comply with HMRC legislation and to ensure all the correct income tax deductions are made.

OK, so how much does it cost?

As with most things, there is a cost to administer a SSAS. The cost to run a Morhart SSAS is very clear and you can find more details here.

As a guide we’ll charge £1,000 p.a. for looking after your scheme, which if your SSAS is valued at £500,000 would equate to a 0.2% annual fee.

Summary

A SSAS is no different to any other pension scheme in terms of what it’s for; it’s there to provide an income for you when you retire. I always think you can sum up the difference between a SSAS and a conventional pension scheme in one word - flexibility.

With a SSAS you can invest your funds how you would like and then take benefits, as you would like, all within a valuable tax-free environment and within HMRC rules.

As mentioned, I’ve tried to make this blog as jargon free as possible and hopefully you have found this useful.

If you would like more information on Morhart, SSASs and the service we provide, please have a look around the website or contact me directly. I’d be delighted to help.

The author

Andy Rogers

Andy is a director of Morhart Pension Services Ltd. He's a lovely guy with a passion for pensions.

[email protected]

0117 457 7784

View Andy's LinkedIn profile