One of the questions we are frequently asked by SSAS clients is regarding the lifetime allowance or LTA - how does it work and can I be caught out by it? There isn’t a limit on the amount of detail you can go into regarding the LTA and how it affects all types of pension schemes so this blog is a brief description of how it works, how it is relevant to SSAS, and what to look out for, in particular when you reach your 75th birthday.

What is the LTA?

The LTA is a threshold on the amount of private pension savings an individual can accrue in the UK, before attracting a tax charge. It applies per individual, not per pension scheme so you will have one LTA for all your private pension provision.

Note: The LTA applies to all private pension provision.

How it started

The LTA was bought into effect by HMRC on 6 April 2006 (known in the pension scheme world as A-Day). Prior to this date, there were various overly complicated regimes of legislation. The new A-Day rules were brought in and retrospectively changed the rules so that all private pension schemes would be governed under one (supposedly) simplified set of rules.

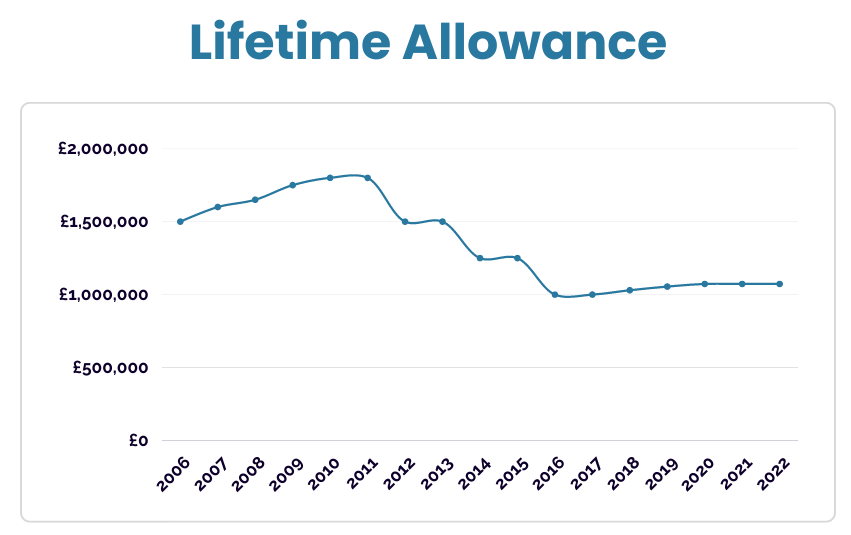

Like other tax thresholds, the LTA is set by HMRC and has varied over the years. Although the LTA is fixed for each tax year, we can see how it has fluctuated since A-Day:

The LTA for the year ending 5 April 2023 is £1,073,100.

How does it work?

Your pension scheme is compared to the LTA at certain events, known as Benefit Crystallisation Events or BCEs (see below for more info). At these events, the value of your pension scheme is compared to the LTA and you will use a percentage up. In most scenarios once you have used up 100% of the LTA, any excess will then be subject to a tax charge. As the amount of LTA used up is illustrated as a percentage you can calculate and monitor the monetary amount of available allowance remaining.

As a simple example, if you took your retirement benefits today, and your fund value is £150,000, you will use up 13.97% of the LTA (£150,000/£1,073,100*100).

If your fund value is higher, say £1,500,000, you will use up 139.78% of the LTA. In this example, as you have exceeded 100% you pay a tax charge on the excess, an amount of £426,900. See below for more information on the level of tax payable together with how it is settled.

BCEs

There are nine events where your fund value will be compared to the LTA. Some of these are more common for SSAS than others, however, for completeness these are all listed below:

A description of each BCE from HMRC can be found here.

What if my fund value is already above the LTA, can I do anything?

You can see from the graph above that the LTA has varied (mainly reduced) since it was introduced in 2006. Over the years it has been possible to protect the LTA at a higher level than the standard. This is useful for anyone who, prior to 2006 already had funds in excess (or close to) the LTA when it was introduced, or when the threshold has reduced over the years.

At the time of writing, it may be possible to protect your LTA at £1,250,000. There are certain provisos to achieve this and if you would like more information, please let me know.

What happens when I reach age 75?

As mentioned above one of the more common questions we receive relates to whether clients can be caught out by the LTA, in particular ‘what happens if I do not take my retirement benefits?’ or, ‘I’ve already taken benefits and have used up my LTA, can I be caught by the LTA again?’ Both these questions are linked to your 75th birthday

What happens if I do not take my retirement benefits?

If you have not taken your retirement benefits the value of your fund at your 75th birthday will simply be compared to the LTA at this point (this is as per BCE 5B above), and if necessary, the relevant tax charge will need to be paid.

Example

- SSAS Member A is 75 today and has a fund value of £1,000,000. The member will use up 93.18% of their LTA (£1,000,000/£1,073,100*100) and no tax charge will be payable.

- SSAS Member B is 75 today and has a fund value of £1,200,000. The member will use up 111.82% of their LTA and a tax charge will be payable on the excess of £126,900.

I’ve already taken benefits and have used up some of my LTA, can my funds be compared to the LTA again?

The short answer to this is yes, it can.

SSASs are self-invested and have the ability to pay pensions from the assets, as opposed to purchasing an annuity. This is sometimes known as income drawdown and the vast majority of clients take advantage of this. Simply put, after you draw your retirement benefits, which usually include an initial tax-free lump sum, and your fund has been compared to the LTA, the funds will remain invested, ready to be used to provide a pension.

In these circumstances, the SSAS funds will be valued at age 75 and any fund growth will be compared to the LTA at this point.

Example

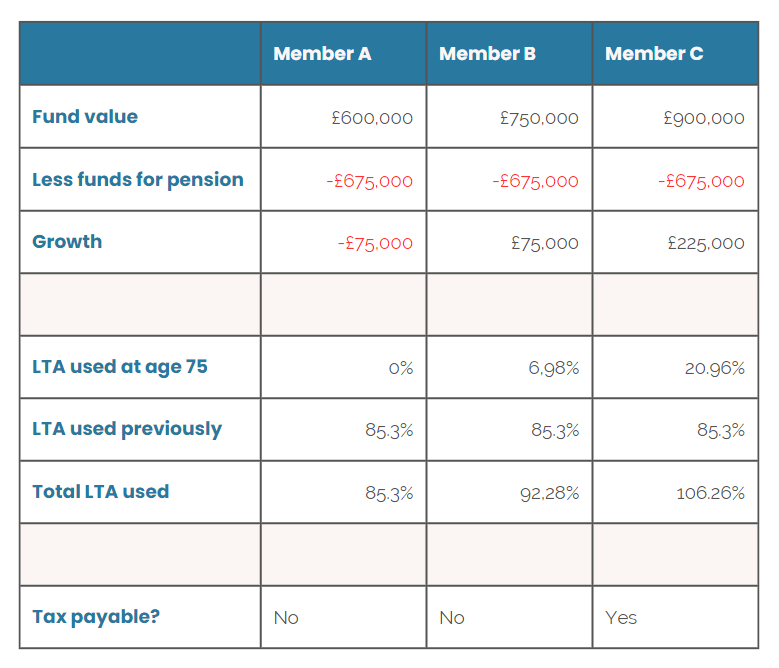

For the purposes of this example, it is assumed that members A, B and C all previously took benefits in 2019. Each member had a fund value of £900,000. A lump sum of £225,000 (25%) was taken and £675,000 remained to provide a pension. 85.30% of their LTAs were used up.

SSAS Members A, B and C are all 75 today and have a fund value of £600,000, £750,000 and £900,000 respectively. The calculation for each would look like the following:

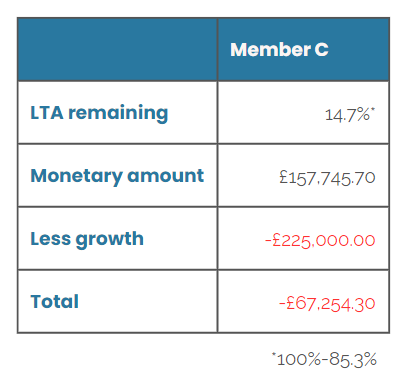

For member C there will be a tax charge on the excess, the excess being £67,254.30. This is calculated as follows:

How much tax do I pay on the excess?

There are two tax charges payable should you go over 100% of your LTA. These are dependent on whether you take the excess as a lump sum or retain them in the SSAS. If you take them as a lump sum the excess is taxed at 55% and you receive 45% as a lump sum. If the funds are retained in the SSAS the excess is taxed at 25%.

As mentioned previously the tax is paid from the SSAS itself.

Example

If a client goes over 100% of their LTA and has an excess of £100,000, the client can take this as a lump sum and will receive £45,000. The remaining £55,000 will then be paid by the SSAS to HMRC. Alternatively, the funds can remain in the SSAS, the member won’t receive anything initially and the SSAS will pay £25,000 to HMRC.

Note:

If the funds are retained, they will be paid out as a pension at some point, and at this time would be subject to income tax. On the basis the member is a 40% taxpayer, the overall tax rate will be 55% - the same as the lump sum option (using the example above 40% of £75,000 is £30,000). This together with the original £25,000 makes a total tax charge of £55,000).

At age 75 the excess funds will automatically be retained, and the tax charge is 25%. For member C above, the tax payable will therefore be £16,813.00.

Summary

The LTA can be complicated and is something to bear in mind, particularly if you are taking a pension using income drawdown. As demonstrated above it can come back and generate an unwanted tax charge when you reach your 75th birthday.

As normal financial advice should be sought whenever necessary.

I hope you have found this useful, if you would like more information on the LTA, the Morhart SSAS, and the service we provide, please contact me directly. I’d be delighted to hear from you.

The author

Andy Rogers

Andy is a director of Morhart Pension Services Ltd. He's a lovely guy with a passion for pensions.

[email protected]

0117 457 7784

View Andy's LinkedIn profile